Trade Alert: Dividend Growth Portfolio Investments, July 14, 2025

Investments Made Weekly On First Trading Day of the Week

Growth of Model Dividend-Growth Stock Portfolio (weekly investments)

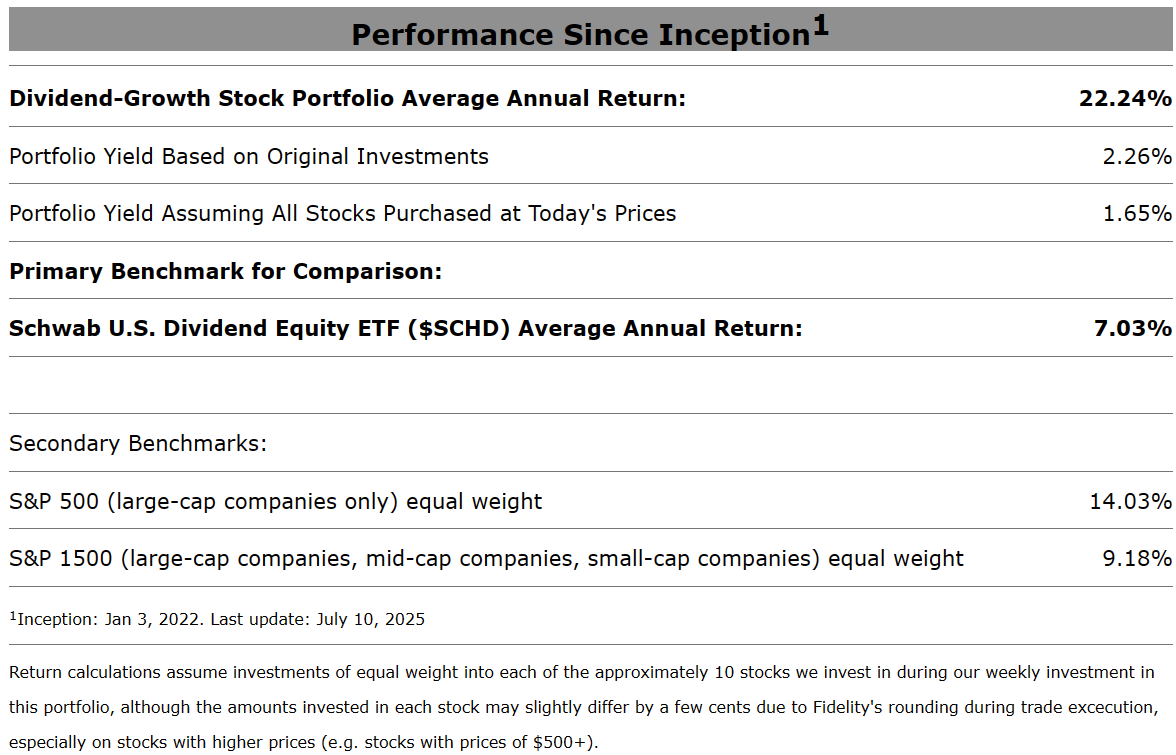

Brief overview: this model portfolio was started in 2022 with weekly investments of $12.50 to show my accounting & finance students that they don’t need a lot of money in order to build a diversified portfolio. Another goal was to see if we can beat the popular dividend-ETF $SCHD, which we are accomplishing so far. In my personal accounts, I’m also investing approximately $3,000 a week into these stocks as I gradually sell my SCHD holdings and move into our strategies.

Stocks in this portfolio that we are selling this week:

Today we plan on selling half of our holdings of WK Kellogg Co. (KLG) because the company is being acquired. Ferrero, (maker of Nutella) confirmed it plans to buy WK Kellogg for $3.1 billion in cash.

Selling half of our shares of KLG this week and the other half next week allows us to reinvest the proceeds into a greater number of stocks, potentially, assuming our buy list changes the next week (which it usually does).

As of Friday, Kellogg has provided our portfolio with a total return of +106.4% in under two years.

Ten Dividend-Growth Stocks we are buying this week:

Below are 3 screenshots of our current ratings of the top 20 dividend-growth stocks. We plan on buying the first TEN stocks unless the stock appears in yellow highlight:

Quality Grade Components of Our 20 Top-Rated Companies:

Dividend Grades of Our 20 Top-Rated Companies:

Under-the-Radar Dividend-Payer(s) we are purchasing this week:

No purchases planned at this time.

Portfolio Performance:

Portfolio Dividends for June Increased 69.04% Over the Previous Month

Recent Dividend Increases of Portfolio Holdings

Enterprise Products Partners $EPD increased its distribution for the 2nd time this year.

Its new payout is 3.8% higher than a year ago, which is remarkable when its current yield is already 6.90%.

This is the 27th consecutive year of increases for the partnership.

EPD, one of my favorite pipeline stocks, is part of High-Yield Stock Portfolio.

A 6.2% dividend increase was announced by PNC Financial Services Group ($PNC). This is the 13th consecutive annual dividend increase by PNC.

The company is part of our Dividend-Growth Stock Portfolio and High-Yield Stock Portfolio.

For the latter, we have made 55 weekly investments into PNC with an average total return of +23.04%.

For our Dividend Growth Stock Portfolio, we have made 16 weekly investments into the bank, for an average annual return of +16.25% so far.

PNC is the sixth largest U.S. bank by deposits and has a diverse business model offering traditional banking, corporate and institutional banking, and asset management.

FAQ: My favorite stock was in your ranking last week, but completely disappeared from your ranking this week. What happened? Do you recommend selling it?

We use many criteria to filter stocks, and if a stock is hovering near the required level of a certain metric, the stock can make the list one week, and then drop off the list based on a small movement in that metric. Examples of criteria used to filter out stocks include “required margin of safety” and “consensus earnings growth estimates over the next 12 months,” which changes frequently. For consensus earnings growth estimates, I will only purchase a stock for this strategy if its earnings are forecast to grow at least 5% over the next 12 months. That’s because we want to invest in stocks that can continue to increase their dividends. A stock might have a 5.2% estimate one week and make the list, but the next week its estimate could dip to 4.9% which means that the stock suddenly doesn’t make the list at all. This is just one of many filtering criteria we use to narrow down our list of investable stocks.

Just because a stock doesn’t make the rankings does not necessarily mean we will sell it. Each week when we list the stocks were are investing in, we will also alert you about any stock we are selling from that portfolio.

Disclaimer: This information has been presented for educational purposes only and is not a recommendation to buy or sell securities or engage in any investment activity. Past performance is never a guarantee of future performance.

Follow us on YouTube and Twitter/X